Is American Airlines Group Inc. (AAL) a buy, sell, or hold in the current market? Despite recent volatility, with a 35% decline in the first three months of 2025, analysts are predicting a potential ~81% upside, making this a critical moment for investors to assess the airline's future.

The financial landscape surrounding American Airlines (AAL) is complex, a tapestry woven with threads of fluctuating fuel costs, evolving EPS outlooks, and the ever-present pressures of the aviation industry. To navigate this terrain, investors must delve into a wealth of information, from stock quotes and historical data to news analysis and expert insights. Understanding the dynamics at play is paramount for making informed decisions, whether you're a seasoned trader or a novice investor.

Let's dissect the current state of AAL, examining its recent performance and future prospects. According to recent reports, American Airlines' Q4 earnings were robust, fueled by lower fuel costs. However, despite exceeding analysts' revenue and earnings expectations, the stock experienced an 8.7% drop, primarily due to a softer outlook for 2025 EPS. This highlights a crucial point: the market isn't solely focused on past performance; it's intensely scrutinizing future projections.

- Andrew Taggart Net Worth A Deep Dive Into His Wealth And Success

- Anita Baker Net Worth A Deep Dive Into The Iconic Singers Wealth

For those seeking to engage in stock trading and investment, the information available is extensive. Resources like Nasdaq provide comprehensive data, including stock prices, historical trends, and breaking news. Detailed analysis, encompassing financial overviews, statistical insights, and expert forecasts, is readily accessible. This abundance of information empowers investors to make educated decisions, rather than relying on guesswork or speculation.

AAL stock quotes, trades, and related financial details are readily available to help investors make informed investment decisions. The ability to track price fluctuations, analyze financial data, and access analyst ratings provides a holistic view of the company's financial health. Furthermore, the integration of community messages and investor sentiment offers a real-time perspective, allowing traders to gauge the prevailing market mood and potential opportunities.

A deeper dive into the company's history, management structure, and the challenges it faces within the aviation industry is crucial for a well-rounded assessment. The sector has its own unique challenges. Consider the impact of global events, geopolitical tensions, and competition from other airlines. A thorough understanding of these factors is indispensable.

- Did Ree Drummond Pass Away In 2024 A Comprehensive Look

- Unveiling Chuck Robbins Net Worth A Deep Dive Into The Life And Wealth Of Ciscos Ceo

The role of analyst ratings and price targets adds another layer of complexity. While some analysts are bullish, assigning an average price target of $20.50 per share, indicating substantial upside potential, others may express caution. It's important to remember that these are projections, and they are subject to change based on evolving market conditions and company performance. These ratings and forecasts give investors a valuable snapshot of the company's potential, as seen by industry experts. However, they shouldn't be considered as definitive guarantees.

Here is an overview of key statistics related to American Airlines Group Inc. (AAL), to help you in your investment journey:

| Metric | Value |

|---|---|

| Ticker Symbol | AAL |

| Company | American Airlines Group Inc. |

| Industry | Airlines |

| Average Price Target (Current) | $20.50 per share |

| Implied Upside Potential | ~81% (from current price levels) |

| Recent Stock Drop | 8.7% (due to 2025 EPS outlook) |

| Stock Gain Since (Date) | 14.4% (since a specific date) |

| Historical Data Source | Nasdaq (Example Link) |

| Analyst Recommendation | Varies (See Analyst Ratings) |

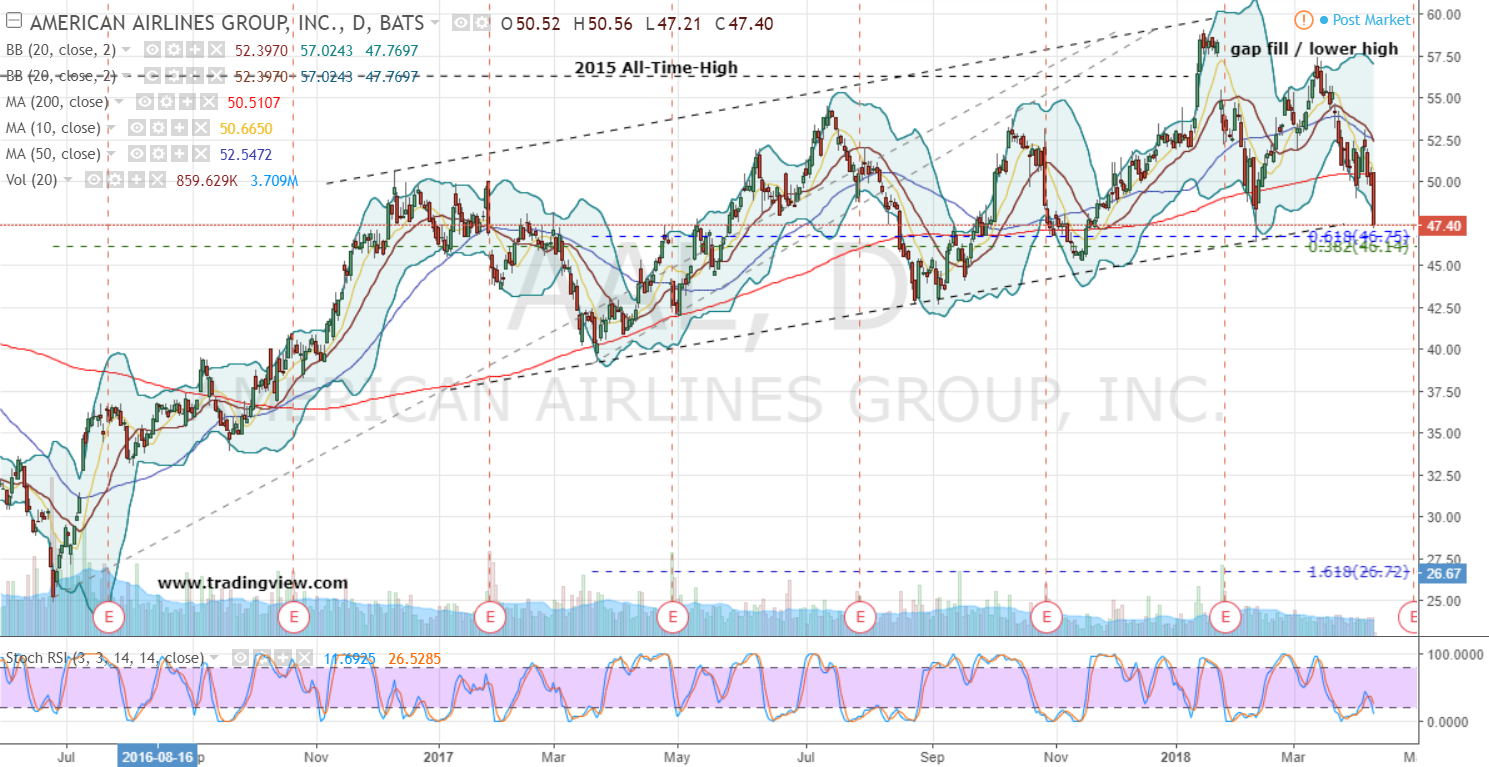

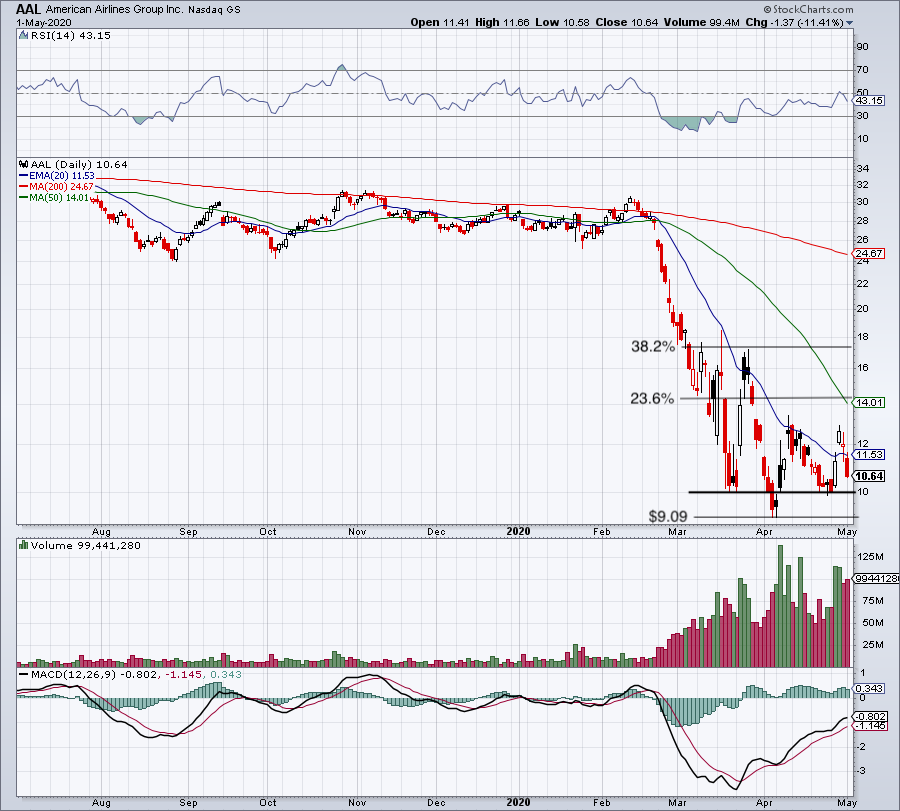

The stock price history for American Airlines Group Inc. (AAL) includes open, high, low, close, and volume data, providing a complete record of the stock's trading activity. This information, starting from its first trading day, is invaluable for technical analysis and understanding price trends. Investors can utilize this data to identify support and resistance levels, chart patterns, and potential entry and exit points for trades.

The "Bearish breakdown trade" plan, with an invalidation level of $11.17 and profit targets, offers a specific example of how traders might approach AAL stock. The presence of such plans indicates that some investors view the stock as vulnerable to a decline, based on technical analysis or other market factors.

The 35% decline of American Airlines stock in the first three months of 2025 is a significant concern for investors. That downturn prompted investors to reconsider the outlook. This highlights the importance of continuous monitoring and analysis. The stock's forward P/E ratio of 5.6x. suggests that the stock may be undervalued. But further assessment is needed to determine the true value.

The insights from Jim Cramer of the Motley Fool, and the information from Insider Monkey, also provide alternative perspectives on the value and potential of American Airlines. This highlights the diverse views available in the market, emphasizing the need for investors to develop their own informed opinions.

The evolution of the airline industry, with its dynamics, presents numerous challenges. The airline's ability to adapt to changing circumstances, manage costs, and maintain a competitive edge is critical. This involves strategies like fleet modernization, network optimization, and customer experience enhancements.

In summary, the analysis of AAL stock necessitates a multifaceted approach. This requires the consideration of historical data, financial statements, expert forecasts, and market sentiment. The aviation industry is a dynamic environment, and the fortunes of American Airlines are intricately linked to these factors. By diligently investigating these details, investors can chart a course toward well-informed decisions, successfully navigating the complexities of the stock market.

This data reflects the complexities of the current financial climate and illustrates how investors need a well-researched outlook to make informed decisions. From the impact of global events to industry changes, investors have to remain well-informed.

Ultimately, the question of whether to buy, sell, or hold AAL stock demands careful deliberation. Its a question best answered by a thorough analysis of the companys financial standing, its industry positioning, and its future prospects. While current data presents both opportunities and potential risks, the success in this market hinges on knowledge and continuous analysis.

Detail Author:

- Name : Mr. Nikko Bins

- Username : ttorp

- Email : graciela98@walter.com

- Birthdate : 2002-11-17

- Address : 384 Patsy Vista Suite 978 New Hymanton, CA 75703

- Phone : +1-747-278-0241

- Company : Pagac-Waelchi

- Job : Religious Worker

- Bio : Sed expedita hic qui minus. Nemo amet architecto explicabo qui voluptatem non dolorem ut. Vitae vel dolores dolorem non impedit.

Socials

linkedin:

- url : https://linkedin.com/in/whitew

- username : whitew

- bio : Et quis a animi. Est et reprehenderit nihil ut.

- followers : 5692

- following : 2144

tiktok:

- url : https://tiktok.com/@whitew

- username : whitew

- bio : Dolor corporis sit doloribus maiores itaque. Soluta et qui repudiandae ab.

- followers : 5391

- following : 2186

facebook:

- url : https://facebook.com/wernerwhite

- username : wernerwhite

- bio : Laborum est rerum cupiditate vero et quibusdam excepturi.

- followers : 3221

- following : 2185

twitter:

- url : https://twitter.com/whitew

- username : whitew

- bio : Laborum qui cupiditate assumenda ipsa aperiam. Est unde officia et. Voluptatem incidunt perferendis quas vero. Explicabo sed tempora qui ab ut.

- followers : 6604

- following : 1772

instagram:

- url : https://instagram.com/wernerwhite

- username : wernerwhite

- bio : Eos mollitia qui nihil ea dolor quo aperiam. Nam enim aut maiores quo ipsum.

- followers : 6455

- following : 231