Are you ready to unravel the complexities of tax season and ensure you're maximizing your returns? Navigating the world of taxes can feel overwhelming, but understanding the key elements can empower you to take control of your finances and potentially save money.

The annual tax filing ritual is upon us, and the need to stay informed is more critical than ever. Whether you're a seasoned filer or a first-timer, knowing your rights, responsibilities, and the resources available can significantly impact your financial well-being. The following guide aims to provide a comprehensive overview, drawing on the latest information and offering practical advice to help you confidently navigate the tax landscape.

Before diving into specific actions, its useful to grasp the fundamentals. Individual income tax, as a core concept, applies to all income earned by residents, and, importantly, income earned by nonresidents from sources within a specific jurisdiction such as the state of Kentucky. The tax laws often mirror the federal Internal Revenue Code, with updates frequently referencing the code in effect as of a specific date. For instance, Kentucky's individual income tax law is based on the Internal Revenue Code in effect as of December 31, 2023.

- Unveiling The Talent Of Merrin Dungey A Journey Through Film And Television

- Kelley Earnhardt Net Worth Inside The Life And Success Of A Nascar Icon

A significant portion of tax preparation involves understanding the various deductions and credits available. Remember that a deduction reduces the income you are taxed on, potentially lowering your overall bill. Credits, on the other hand, directly reduce the amount of tax you owe. Understanding these differences can be crucial in minimizing your tax liability.

Tax season, typically culminating around April 15th each year, has specific deadlines. However, there are always exceptions. For 2024 tax returns, the deadline is April 15, 2025. Certain situations, such as living outside the country on the due date, can grant you an extension.

In many regions, you can find support through local IRS Tax Assistance Centers (TACs), offering various services, including assistance with tax issues, access to forms, and the option to schedule appointments. Remember to consult the official IRS website to locate a TAC and understand the offered services.

- Dillion Harper Today A Deep Dive Into Her Life Career And Current Ventures

- Jamie Murray Career Earnings A Deep Dive Into The Tennis Stars Financial Success

The availability of online resources is something that you should be aware of. Online portals offer multiple functionalities, including: registering to access the tax portal, or clicking a link to submit a request. You can also explore your options on how to check your refund status, find help filing your taxes, and get federal tax forms. The mytaxes page is the place to go for FAQs, guides, and videos. Taxpayers are also encouraged to use free income tax calculators, available on numerous websites, to estimate their federal, state, and local tax burdens for the current filing year. Simply enter your income and location for an estimate.

Taxpayers in need of support should consider all the available options. You can learn how to file your taxes for free using services like IRS Direct File, IRS Free File, or IRS VITA/TCE. You can also determine if you qualify for free tax preparation and filing services in your local area. For immediate assistance, consult the mytaxes page for frequently asked questions, quick reference guides, and videos. Be aware that during peak times, you might experience higher than normal call volumes and wait times.

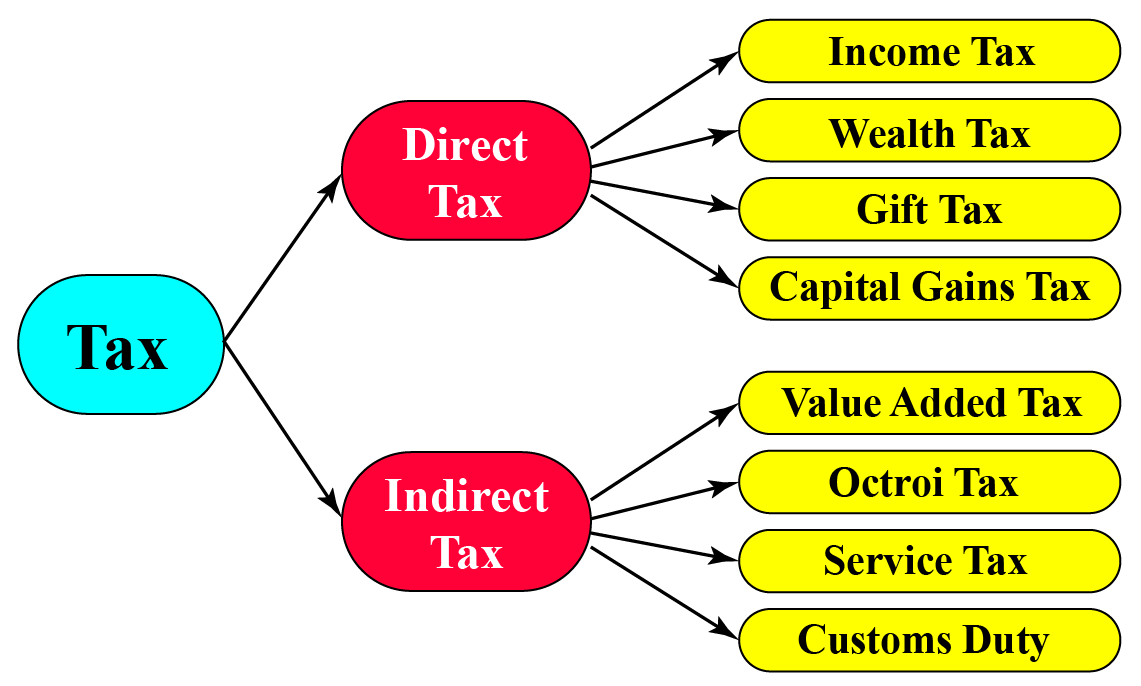

Here is a quick view on the tax information

| Aspect | Details |

|---|---|

| Overview | Provides insights on tax law, filing procedures, and available resources. |

| Tax Types | Focuses on individual income tax obligations. |

| Key Dates | Highlights important deadlines. The tax deadline for 2024 returns is April 15, 2025. |

| Deductions and Credits | Explains deductions (lowers taxable income) and credits (directly reduces tax liability). |

| Filing Support | Covers free filing options (IRS Direct File, IRS Free File, VITA/TCE) and local assistance centers. |

| Resources | Lists online portals, frequently asked questions, and tax data explorers. |

| Tax Return Status | Shows ways to check the status of your tax refund. |

| Tax Filing Tools | Offers information on tax preparation tools such as TaxAct, H&R Block, and TurboTax. Note: Some of these tools provide free services to certain taxpayers, based on their adjusted gross income (AGI). |

| Additional Resources | Includes links for:

|

For those residing in New York, the official website of the NYS Department of Taxation and Finance offers comprehensive resources and online services. Taxpayers can check their refund status, learn about tax responsibilities, and access online services anytime.

Taxpayers in Kentucky have the option to check the status of their state tax refund online. Additionally, the Tax Foundation's tax data explorer tool allows exploring the latest Kentucky tax data, including tax rates, collections, and burdens.

Multiple resources are available to help you during tax season. TaxAct simplifies filing, while H&R Block offers services to prep and file federal tax returns to maximize your refund. Both services guarantee their services, no matter how you file. Additionally, if your adjusted gross income (AGI) was $84,000 or less, reviewing offers from trusted partners might qualify you for a free federal return.

Taxpayers have a range of tools and services to help manage their tax obligations.

Several options are available for free tax filing. Learn how to file your federal and state taxes for free through IRS Direct File, IRS Free File, or IRS VITA/TCE. Determine if youre eligible for free tax preparation and filing services in your area. Many organizations offer free tax help to those who qualify.

Taxpayers should consider utilizing online tools and calculators. Estimate your 2025 federal taxes or refund using free income tax calculators. Enter your income, age, and filing status to start. For example, you can calculate your federal, state, and local taxes for the current filing year. Simply enter your income and location to estimate your tax burden.

If you're looking for tax advice and preparation, many are available. Taxact makes it easy to file today. Also, easily prep & file your federal tax return with H&R Block to maximize your refund. No matter how you choose to file taxes this year, our services are guaranteed.

For those comfortable with the Spanish language, TurboTax Free Edition is available to help file your tax return at no charge. Only simple returns with Form 1040 are supported (without schedules, except for the Earned Income Tax Credit, Child Tax Credit, and student loan interest).

Many entities provide services to facilitate tax obligations. Aztaxes.gov allows electronic filing and payment of Transaction Privilege Tax (TPT), use taxes, and withholding taxes. The City of Lansing provides an online income tax office with resources on federal, state, and local income tax information. For those in Tarrant County, you can pay your tax bill, search for an account, sign up for paperless billing, and review payment options and truth-in-taxation information. Remember to review all available options.

The tax season provides various options to save money. A deduction cuts the income you're taxed on, which can mean a lower bill. A credit cuts your tax bill directly. Various resources are available to help you. Explore options for getting your federal tax refund, how to check your refund status, how to adjust next years refund and how to resolve refund problems. Check the status of your tax refund online. Find help filing your taxes, and get federal tax forms.

Filing taxes can be a challenge, it involves making choices. Choose a trusted partner to file your taxes. Many services are available to assist you. These 14 tax tutorials will guide you through the basics of tax preparation, giving you the background you need to electronically file your tax return. If your adjusted gross income (AGI) was $84,000 or less, review each trusted partner's offer to make sure you qualify for a free federal return.

To aid your tax preparation, understanding the different elements of taxation is key. For instance, know who qualifies as a dependent and how to report interest from a Form 1099. These elements will help you when filing your taxes.

Internal Revenue Service (IRS) provides a great place to learn everything you need to know about taxes.

Detail Author:

- Name : Lauretta Rodriguez

- Username : desiree63

- Email : yfriesen@hotmail.com

- Birthdate : 1986-03-29

- Address : 95850 Schimmel Ville New Tatyanahaven, WA 96587

- Phone : 352.695.6463

- Company : Boehm Ltd

- Job : Bicycle Repairer

- Bio : Totam qui asperiores ullam. Qui laudantium cum odit natus eveniet fugiat tempora nam. Doloribus et accusamus doloremque praesentium non qui.

Socials

tiktok:

- url : https://tiktok.com/@lila_hayes

- username : lila_hayes

- bio : Animi soluta quam quaerat fugit vel. Sequi ut aut qui mollitia.

- followers : 5838

- following : 1153

twitter:

- url : https://twitter.com/lila1756

- username : lila1756

- bio : Quidem velit qui quia rerum enim est. Facilis quidem accusamus repellendus. Dolorem similique sed excepturi aperiam impedit.

- followers : 1478

- following : 2403